The letter box companies of multinationals are concentrated around Amsterdam. The sector that enables tax avoidance provides with jobs and income for the Netherlands, but that won’t silence the criticism.

Forget about the neighborhood Forst Hills in Queens, New York. Forget the decor containing the skyscrapers and bridges of Manhattan. Superhero Spiderman does not live in the United States, nor does live in a reserve for all creations made by Marvel Comics – the American company that has invented, and produced cartoons and movies about, many of the worlds superheroes.

Spiderman lives, together with other characters, heroes and foes out of the series, in room 2.03 on he second floor of a business complex near Schiphol, under the fumes of the Amsterdam airport.

There, on one of the company terrains surrounding Schiphol, since December 23rd of 2008, settled the cooperation SM (Spider Man) Characters UA – one of the many corporations in Marvels international Christmas tree which is in the end all part of The Walt Disney Company.

Where Spiderman usually displays the biggest acts of heroism, the activities are of the cooperation named after him are modest. The cooperation SM is, according to the annual accounts, mostly simply a parking lot and transfer for funds. In 2011, the last year for which an annual account was presented, in excess of 2 billion euros flowed through the Spiderman cooperation.

Spiderman is certainly not the only one keeping office at the Beechavenue at Schiphol. Research done by de Volkskant shows that there are another 159 companies holding office in the building owned by Corporate Services Amsterdam.

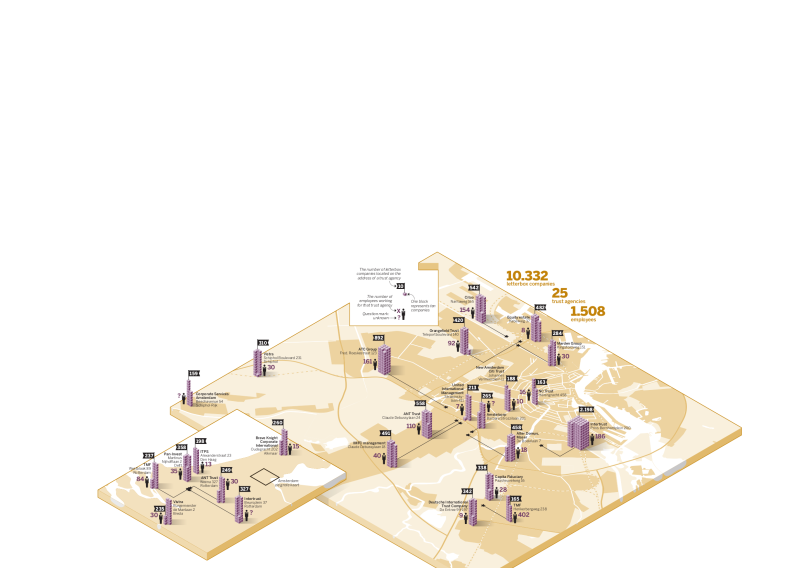

159 companies makes Corporate Services Amsterdam one of the smaller on the Dutch map containing all the addresses of international companies. Intertrust, located at Prins Bernhardplein Amsterdam, has 2198 resident companies, including companies such as fashion warehouse Marks & Spencer, food concern Danone and weapon manufacturer Lockheed Martin.

Closeby, at Fred Roeskestraat in Amsterdam, the company ATC provides ‘offices’ for amongst others, financial power Goldman Sachs, and telecom giant Vodafone.

The Volkskrant research shows that the letter box companies of multinationals are concentrated in and around Amsterdam. Historically, Amsterdam has the most services providers, lawyers and advisers that can help creating and administrating fiscal routes. Furthermore, Schiphol is close by, in the case old-fashioned autographs need to be signed or meetings need to be organized to keep the flow of money and corresponding structures up-to-date.

For years advisers, trust agencies and banks could, undisturbed, continue to add to the impressive system of Dutch postal box firms. The Ministry of Finance, accountants and the business sector: everybody seemed to love Amsterdams junction in the international highway of funds. It brought high quality, even green, employment with it. Moreover: if the Netherlands wouldn’t do it,some other country such as Ireland, Luxemburg or Cyprus certainly would.

However, it is 2013, and in the light of the economic crisis it is no longer self-evident that multinationals try to pay as little in tax as possible. All the more so now that the costs of the crisis are felt by governments and individual taxpayers.

According to trust agency TMF director Jaap van Burg there are competitors in the horizon. One of the countries trying hard to take over the position of the Netherlands is the United Kingdom. It even goes so far that the English tax agency is organizing roadshows across to the United states to lure companies to the British islands.

According to the last report there are 2.200 people working in the trust sector. According to André Nagelmaker of ANT Trust & Corporate Services N.V. the number is currently much higher. The revenues, estimated at 1.5 billion euros, is also a very low estimate according to Nagelmaker.

In short, the trustsector and the structure of tax treaties surrounding it, is profitable for the Netherlands. It supplies with jobs and funds. Whomever that would want to tinker with it is playing with fire and billions – money from almost all large companies of the world. So the implicit message to politicians, journalists and activists: stop discussing it.

One point of discussion, however, could be the employment the sector provides for. The de Volkskrant investigation shows there aren’t huge amounts of jobs concerned with the sector. For example intertrust only needs 186 employees to provide for the tax desires of 2.198 multinationals. One employee for every ten companies. ANT trust needs 110 employees for 558 companies. One employee for every five companies.

In total there are 1508 people working at the addresses with the 25 highest amount of companies at one address. They provide the needs for 10.332 companies. All in all, every employee for every seven companies. Is that really a lot? The same could be asked for the tax income coming from the sector. This could range from 1.5 billion to more. Is that really a lot, or a mere palliative?

An additional problem is that the income should be put into context with the international losses, such as the erosion of the tax income in African countries and the unfair competition between small and middle sized companies that still pay full fare in taxes.

Spidermans most famous foe is the Green Goblin, an alter ego of the ruthless Norman Osborn. Where Spiderman fights for the good, Osborn fights for world domination and the destruction of Superman.

Good or evil: for the fiscal spaghetti of founder Marvel Comics it doesn’t really matter. At coöperation SM Characters UA the dollars that are earned by the Green Goblin are brotherly parked next to that of Superman, both outside the reach of the American tax authorities.